International monetary system and gold reserves: The new old story

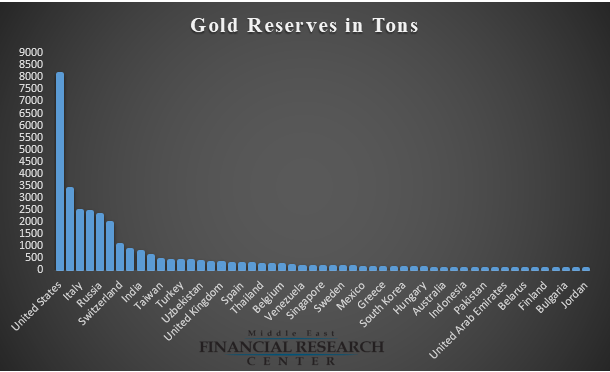

The graph used countries’ gold reserves as declared as of the second half of 2021. Economists believe that Russia and China will declare much larger amounts of gold reserves in 2022 and warn that the aftermath of COVID-19 and the war in Ukraine will result in resetting the international monetary system-needless to say that we are living in a very divided world. Economists also believe that the gold price is being manipulated and that it will rebound back to a lower and more stable level (WHEN??? No one really knows). Both Russia and China seem to be pushing towards going back to the gold standard and have been accumulating gold reserves for a number of years.

The United States and the dollar are facing great challenges due to the overvalued dollar, high and out-of-control inflation rates, public debt that exceeds 120% of GDP, and expectations of a long-lasting recessionary situation at the world’s doorsteps (some believe it will last for up to 10 years). Economists believe that the hike in US inflation was driven by an increase in money supply rather increase in demand for goods and services and cast doubt on the ability of interest rate increases to reverse inflation behavior. Countries that have their currencies fixed against the U.S dollar or pegged it with the dollar must take note and prepare for the worst.

Jordan’s gold reserve is 37.32 tons valued at around US$ 2.4 billion (One ton of gold equals 35274 ounces and one ounce is equal to 28.3495 grams).

On the other hand, China has had the largest US reserves (well over US$ 3 trillion of foreign currency reserves mostly US$) since 2009 in the form of US treasury debt instruments. Therefore, it is unlikely that China will be able to abandon its dependence on the US dollar over the short run besides it is not in its best interest for the dollar to take the back seat. As for Russia and its war on Ukraine, the economic impact of the war should not be exaggerated-except for shortages in global food supply- because the war was politically driven in the first place and Russia is taking the huge economic risk because Europe may manage to live without Russian Gas or find a substitute for it. So, prolonging the war reduces Russia’s gains and significantly magnifies its political and economic costs.