- The assumptions upon which the budget was prepared are based on IMF projections of nominal and real growth and inflation rates instead of the projections of internal sources like the economic modeling departments of the Central Bank of Jordan, Ministry of Finance, and Ministry of Planning & International Cooperation. This is necessary because the IMF projections are dynamic and change continuously and therefore, less reliable

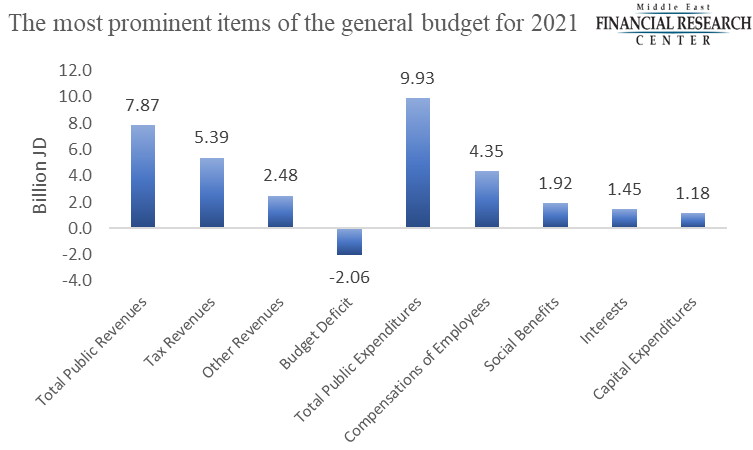

- Revenues from income and corporate taxes are expected to decrease due to the decrease in financial and nonfinancial corporations’ earnings as a result of covid19 aftermath. Yet, the Ministry of Finance has taken measures to improve the efficiency of tax revenue collection and alleviate tax avoidance and evasion with no change in tax rates or giving any tax breaks.

- The financial resources allocated to the Ministry of Health have been reduced by about JD 6 million of what was allocated to the Ministry in 2020 despite the need to deal with the aftermath of the covid19.

- The financial resources allocated to fund social safety net programs have been reduced from JD 200 million to JD 129 in 2021 despite the increase in unemployment and poverty rates. Not all safety net funding represents allocations related to social safety program but instead are payments of previous obligations.

- The cost of two projects of the new capital projects is 112 million dinars, which represents 65% of the total cost of new projects that are estimated at 171 million dinars. These two projects are investment stimulus and workers support programs. Most of the remaining new capital projects cost belongs to the Ministry of Education. This brings into question whether the budget is in fact expansionary.

- The government raise the capital expenditures allocated to fund projects on the governorate level, by approximately 3 million only relative to the estimated expenditures for the year 2020. As a result, this does not help the governorates significantly to benefit from these allocations that help to accelerate economic growth.

- Gross public debt is expected to increase by 2.5 billion dinars in 2021.

- The debt service of internal and external debt expected to increase due to the significant increase in the budget deficit. In addition, funding retirement allocations is also expected to increase due to the large numbers of employees retired in 2020. This will put further pressure on the government’s ability to allocate more funds for capital projects which are necessary to enhance economic growth.