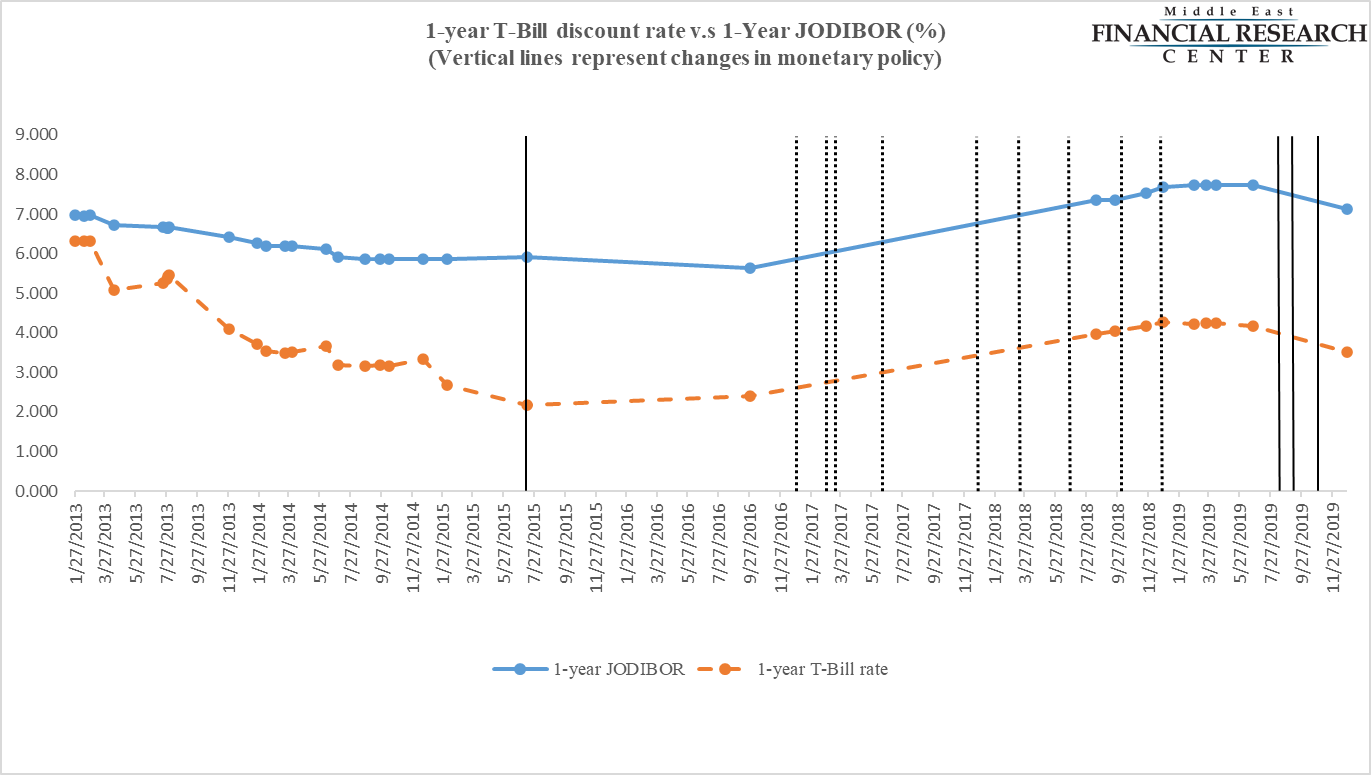

Before 2013, Jordanian banks used the LIBOR as reference rate to adjust interest rates on their floating-rate loans. The Association of Banks in Jordan developed a local equivalent to LIBOR, the JODIBOR, and launched it in 2013. In February, 2015, the Central Bank of Jordan (CBJ) introduced the CBJ main rate whose changes were intended to reflect changes in CBJ’s monetary policy which banks are expected to follow. In the graph above, the vertical solid (dotted) lines represent reductions (increases) in the CBJ main rate.

Although changes in 1-year JODIBOR move in the same direction as changes in the CBJ main rate, they closely mimic changes in the discount rate on 1-year T-Bills indicating that banks follow changes in the T-Bill discount rate rather than the CBJ main rate when adjusting the JODIBOR.

Notably, the difference between the 1-year T-Bill discount rate and 1-year JODIBOR remained expanding until it stabilized at 3.5%, on average, since mid of 2015, as shown in the graph above. (similar results are also found for the 6-month and 3-month JODIBORs versus 6-month and 3-month T-Bill discount rates except that the difference between the 3-month JODIBOR and 3-month T-Bill discount rate stabilized at 2.5%, on average).