Domestic inflation could continue to rise and broaden further. Furthermore, disinflationary policies could be more costly than expected, both globally and domestically.Similarly, a lack of harmonization between monetary and fiscal policies would add to inflationary pressures, requiring even tighter monetary policy to tame inflation.

Thus, higher food prices and more pervasive food and energy shortages could lead to food insecurity and social unrest, particularly in 2023. However, tighter-than-expected financial conditions could trigger debt and external stress and financial stability risks. In some countries, the banking system’s capacity to lend to the government is already limited due to elevated public sector exposure, raising the risk of a funding crunch. Resorting to monetary financing would fuel inflation further.

In an increasingly difficult and uncertain global environment, with policymakers across the region battling inflation and high debt, policies will differ across different groups. EM&MIs and LICs will need to preserve fiscal sustainability while ensuring social stability. Oil exporters will need to maximize the benefits of the oil windfall in an uncertain environment by building buffers and making progress with their transition and diversification plans. Nevertheless, the near-term priorities for all countries are to maintain or restore price stability while protecting the vulnerable, respond to tightening global financial conditions while ensuring financial stability, ensure food and energy security, and manage lingering pandemic-related risks. Given looming fragmentation risks, global and regional cooperation is critical to achieving these objectives. The worsening global environment, tightening macroeconomic policies, and the limited policy space in several countries raise the urgency of pressing ahead with structural reforms to bolster economic growth while transforming economies to become more resilient, sustainable, diversified, and inclusive ones.

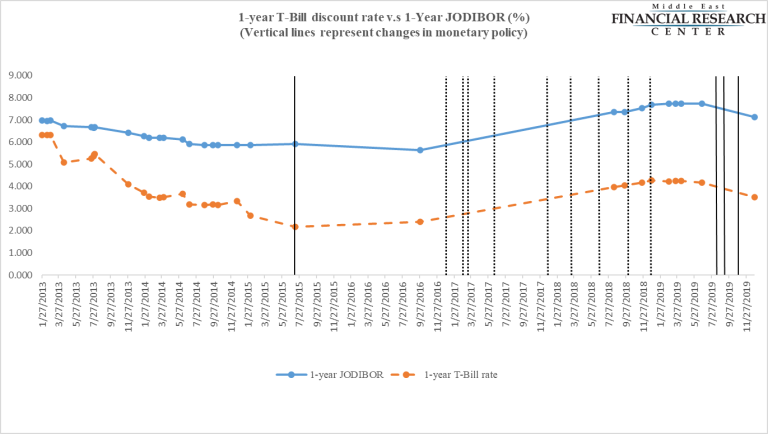

Modernizing monetary frameworks could include measures such as (1) focusing monetary policy on domestic price stability while strengthening central banks’ autonomy; (2) reducing dollarization, including by developing financial markets and institutions; (3) enhancing communication and increasing the transparency of monetary operations and foreign exchange interventions; and (4) focusing on returning inflation to targets to help anchor inflation expectations.

Including managing lingering pandemic risks and preparedness to act swiftly and equitably in response to the next variant or pandemic threat. At the same time, domestic revenues should be boosted by eliminating widespread tax exemptions and inefficient tax incentives and strengthening revenue administrations to reduce tax avoidance and evasion (see Verdier and others 2022). In cases where fiscal consolidation is not feasible and debt sustainability is at risk, debt operations may need to be considered.

Oil exporters need to maximize the benefits of the oil windfall for the next generations by building buffers, keeping fiscal reform momentum, and progressing with their diversification plans. They should avoid procyclical spending (or continue to avoid such policies), particularly raising spending categories that would be difficult to reverse once oil prices fall (for example, public sector hiring and wage increases).

Reform priorities include:

- Redesigning tax systems

- Reducing informality, including through well-designed tax policies, could boost productivity while also facilitating the inclusion of women and youth in labor markets.

- Fostering private sector development by easing the entry of new firms, eliminating barriers, and preventing existing ones from scaling up.

- Stepping up digitalization to foster efficiency, inclusion, and resilience by broadening the coverage of digitalization and internet connectivity and scaling up investments in new technologies.

- Taking measures to adapt to the climate challenge.

High international food and fuel prices are exacerbating fiscal pressures in the Middle East and North Africa (MENA) at a time when countries face tightening global financial conditions and extraordinary uncertainty, while policy space is reduced from the pandemic. During past episodes of rising commodity prices, policymakers responded swiftly to mitigate their impact. However, responses often lacked targeting and prior planning, resulting in adverse fiscal and distributional impacts, including (1) large and persistent fiscal loosening, (2) increased budget rigidity, and (3) diminished budget equity, all combined with (4) a lack of offsetting fiscal adjustment.

These responses heightened debt sustainability risks for oil importers and led to procyclical fiscal policies in oil exporters, followed by abrupt fiscal adjustments when oil prices fell. While most MENA countries have once again resorted to similar policy responses as in the past, particularly generalized price subsidies, they have done so on a smaller scale. This reflects a more limited fiscal space and past progress—albeit unfinished—with subsidy reform. While countries foresee some fiscal expansion in 2022 compared to prewar expectations, they are expected to continue their subsequent adjustment paths. As the global outlook remains challenging and downside risks extraordinary, it will be important for policymakers in the region to consider (1) cost-effective measures to address the pressures from rising food and fuel prices and (2) reforms to enhance fiscal resilience, including reduced dependency on fuel, ahead of the next commodity cycle.