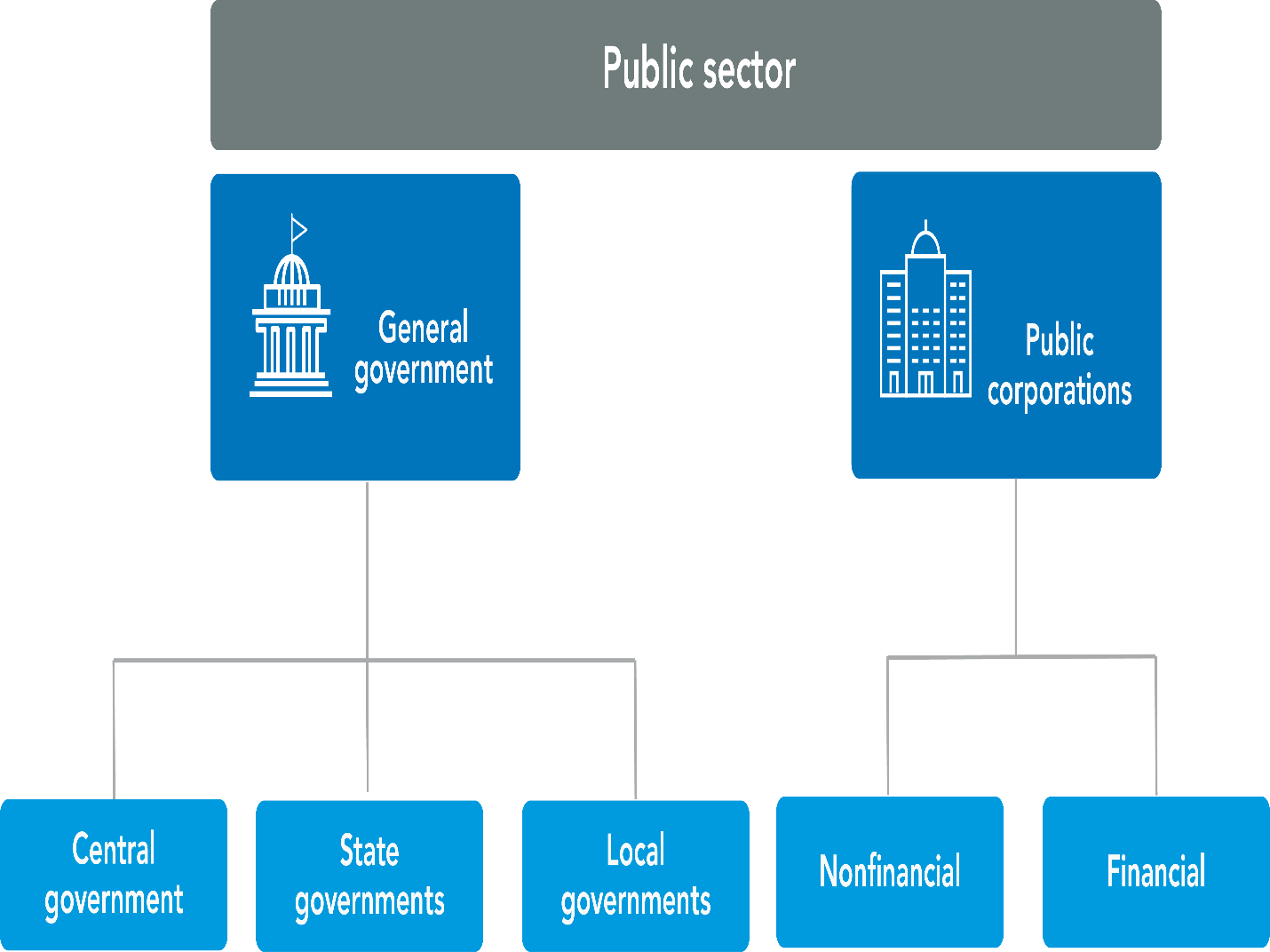

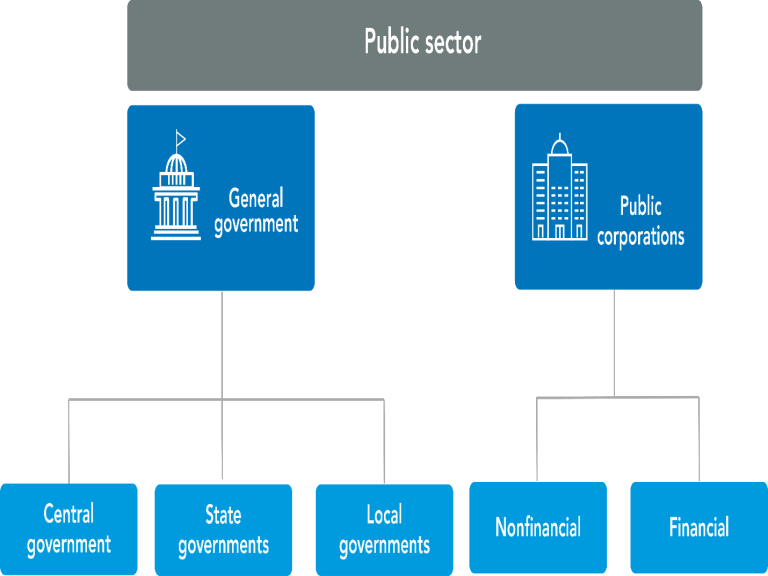

At the end of 2020, the Jordanian government decided to implement the definition of General Government instead of Central Government, and given the lack of consensus on a unified definition of general government, Middle East Financial Research Center (MEFRC) considered to present the most prominent definitions in this regard, which was issued in Government Finance Statistics (GSF) manual for 2014. Thus, to better understand the impact of fiscal policies on the economy, Government Finance Statistics (GFS) defines the public sector in its 2014 manual as follows:

The general government sector is composed of central government, state governments and local governments; as well as the components of these three levels of government: budgetary units, extrabudgetary units and social security funds.

The public corporations subsector is composed of: public nonfinancial corporations and public financial corporations; as well as the components of the public financial corporations, which are: public deposit taking corporations and other public financial corporations.

Government finance statistics can be compiled for each subsector or any combination of these subsectors of the public sector. The subsectors and institutional units that are covered in the compilation of statistics for any given country is referred to as the institutional coverage of GFS for that country. We recommend compiling GFS for the whole public sector and its subsectors. However, many countries begin with certain subsectors, such as central government, and then gradually over time expand the institutional coverage of its GFS.

The general government sector consists of all resident institutional units that carry out the functions of government as their primary activity. These units perform the economic functions of government, execute their political responsibilities and act as economic regulator.

There may be more than one level of government within a country, depending on legal and administrative arrangements. The definition of different levels of government is based on the degree of autonomy and the exercise of political authority over progressively smaller areas of a country.

In practice, the degree of autonomy of the level of government is measured by its ability to:

- Finance itself by imposing taxes or fees

- Decide how to use its resources

- Appoint its own officers

These criteria determine the classification of a government unit into a given level, not the name of the unit. For example, many countries have geographical areas denominated states, provinces, or regions, which have very limited degree of autonomy. In these cases, and for macroeconomic statistical purposes, these countries are considered not to have a state level of government, instead these units would be classified as part of the central government that provides the funds and determines the ways those funds are spent. Let’s look at an example:

Most macroeconomic statistics (i.e. the national accounts, balance of payments and international investment position, and monetary and financial statistics) use the concept of general government. For macroeconomic policy making and analysis, it is important to have a robust and consistent definition of the general government sector, which requires proper identification of all the institutional units that belong to this sector.

The public corporation’s subsector consists of all resident corporations controlled by government units or by other public corporations. It includes quasi-corporations and market nonprofit institutions (NPIs) under control of government, while it excludes corporations that are not classified as corporations for statistical purposes because they don’t charge economically significant prices.

Based on the nature of the goods and services they produce, nonfinancial goods and services or financial services, the public corporations subsector is divided into the public nonfinancial corporations subsector and the public financial corporations subsector. Typical examples of public nonfinancial corporations are national airlines, national railways, national electricity companies, national oil or gas companies, and national mineral companies. Typical examples of public financial corporations are central banks, commercial banks, development banks, insurance corporations and pension funds.

Now that we have discussed all the subsectors of the public sector, it is important to mention that countries compile GFS for different combinations of these subsectors and sectors (and, in some cases, even large individual units). The choice about which specific combinations of GFS sectors and subsectors a country may choose to compile depends on two factors:

- the relative importance of certain subsectors to analyze fiscal policies and their impact on the economy.

- the availability and timeliness of information on the units of a given subsector.

Four of the most analytically useful consolidated groups are:

- Central government sector, composed of the budgetary central government, extrabudgetary central government, and national social security funds;

- General government sector, composed of the central government sector, state and local governments and all social security funds;

- Nonfinancial public sector, composed of the general government sector and the public nonfinancial corporations subsector; and

- Public sector, composed of the nonfinancial public sector and the public financial corporations subsector. Note that this definition of public sector is equivalent to the definition used throughout the module: general government sector plus public corporations subsector.

Two other groupings countries may find analytically useful are:

- General government sector plus the central bank.

- Central government public sector, composed of the central government subsector plus the central government controlled public corporations.

Cross-country comparisons of GFS are only analytically valid and meaningful at the level of the general government sector and the public sector. At these two levels, international comparisons can be made because the internal organization of a given country’s government (or public sector) does not affect the compilation of GFS. In other words, the GFS framework definitions of the general government sector and the public sector capture all institutional units that belong to a country’s entire government or public sector.